Cryptocurrency is a digital or virtual form of currency that uses cryptography for secure transactions. Unlike traditional money issued by a central bank, cryptocurrencies operate on decentralized networks powered by blockchain technology. This innovative digital asset class, led by Bitcoin and Ethereum, has transformed the way we think about finance, investment, and technology.

How Does Cryptocurrency Work?

Cryptocurrencies rely on blockchain technology, a distributed ledger that records every cryptocurrency transaction transparently and securely. This ledger is maintained across a blockchain network, ensuring no single entity, like a financial institution, controls the system. Transactions are verified through processes like proof of work or proof of stake, with miners or validators securing the network.

For example, when you buy cryptocurrency, the transaction is recorded on the blockchain, accessible via a digital wallet secured by a private key. This makes cryptocurrencies such as Bitcoin a medium of exchange without intermediaries.

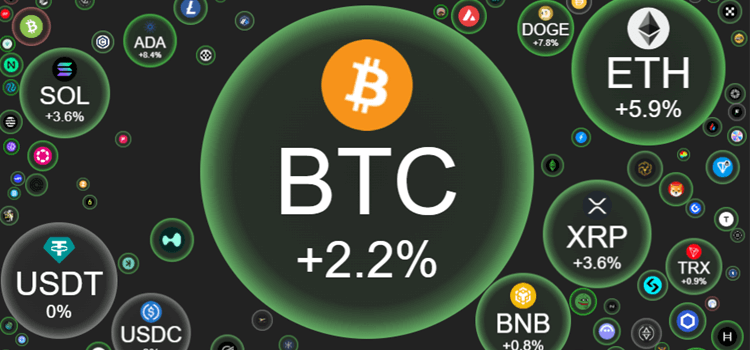

Top 8 Cryptocurrencies to Know

The cryptocurrency market is vast, with thousands of digital currencies. Below, we explore the top eight coins by market capitalization and their unique features.

Cryptocurrency is not just a new form of money; it’s a revolution in trust, powered by blockchain technology.

1. Bitcoin (BTC)

Bitcoin, the first cryptocurrency, was created in 2009 by an anonymous figure, Satoshi Nakamoto. Often called digital gold, Bitcoin is the most valuable cryptocurrency, widely accepted as a payment method. Some countries, like El Salvador, even accept Bitcoin as legal tender. Its decentralized nature and limited supply make it a popular cryptocurrency for investment.

2. Ethereum (ETH)

Ethereum is more than just a cryptocurrency; it’s a blockchain platform that supports smart contracts—self-executing agreements coded on the Ethereum blockchain. Ether (ETH) powers the network, making it a top choice for developers and cryptocurrency investors. Ethereum’s versatility drives its position as the second-largest crypto by market cap.

3. XRP (XRP)

XRP, created by Ripple, is designed for fast, low-cost cross-border payments. Unlike Bitcoin, XRP transactions settle in seconds, making it appealing for financial institutions. Despite regulatory scrutiny from the Securities and Exchange Commission, XRP remains a major player in the cryptocurrency market.

4. Binance Coin (BNB)

Binance Coin is the native token of the Binance crypto exchange, one of the largest platforms to buy cryptocurrency. BNB is used for trading fees, staking, and powering the Binance Smart Chain. Its utility and the exchange’s dominance make BNB a strong investment in cryptocurrency.

5. Solana (SOL)

Solana is a high-speed blockchain platform known for low-cost transactions and scalability. Its native token, SOL, fuels the network, supporting decentralized apps and smart contracts. Solana’s efficiency has made it a favorite among developers and crypto investors.

6. Dogecoin (DOGE)

Originally created as a joke, Dogecoin has become a popular cryptocurrency thanks to community support and endorsements from figures like Elon Musk. While it lacks the technical depth of Ethereum, DOGE is used for tipping and small cryptocurrency payments.

7. TRON (TRX)

TRON is a blockchain platform focused on decentralized content sharing and entertainment. Its native token, TRX, powers transactions on the network. TRON’s low fees and high throughput make it a compelling choice for developers and those looking to buy with cryptocurrency.

8. Cardano (ADA)

Cardano is a blockchain platform emphasizing sustainability and scalability through a proof-of-stake model. Its token, ADA, supports staking and transactions. Cardano’s research-driven approach appeals to those seeking long-term cryptocurrency investments.

Is Cryptocurrency a Good Investment?

Investing in cryptocurrency can be rewarding but carries risks. The cryptocurrency market is volatile, with prices of Bitcoin and other cryptocurrencies fluctuating wildly. A solid investment strategy involves researching types of cryptocurrency, understanding market cap, and diversifying cryptocurrency holdings.

To start, visit a cryptocurrency exchange like Coinbase or Binance to buy cryptocurrency. Store your cryptocurrency in a digital wallet, such as a cold wallet, for added security. Always consider whether cryptocurrency is safe for your financial goals.

How to Store Cryptocurrency Safely

To store cryptocurrency, use a digital wallet—either a hot wallet (online) or a cold wallet (offline). A private key secures your wallet, ensuring only you can access your crypto. Avoid sharing this key and consider reputable wallets to keep your cryptocurrency safe.

Is Cryptocurrency Legal?

Cryptocurrency’s legality varies by country. Some, like the U.S., regulate the cryptocurrency market through agencies like the Commodity Futures Trading Commission and the Securities and Exchange Commission. Others, like El Salvador, accept Bitcoin as legal tender. Always check local laws before engaging in cryptocurrency trading or payments.

Why Use Blockchain Technology?

Blockchain technology works by providing a transparent, tamper-proof ledger for cryptocurrency transactions. Beyond crypto, companies that use blockchain technology apply it to supply chains, healthcare, and more. Understanding how cryptocurrency works often starts with grasping blockchain’s role in securing digital assets.

Getting Started with Cryptocurrency

To use cryptocurrency, start by choosing a crypto exchange to buy Bitcoin, Ethereum, or another cryptocurrency. Set up a digital wallet, learn about cryptocurrency prices, and explore how to accept cryptocurrency for goods or services. With many cryptocurrency exchanges available, the process is more accessible than ever.

Cryptocurrency is reshaping finance, offering new ways to invest, pay, and innovate. Whether you’re drawn to Bitcoin’s legacy or Ethereum’s smart contracts, the crypto world is full of opportunities—just proceed with knowledge and caution.