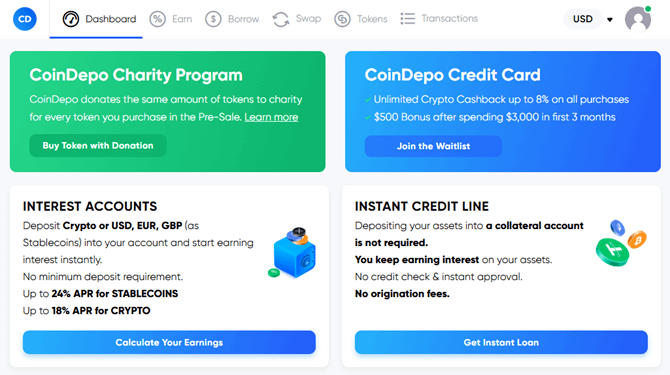

To maximize returns, I took a low-interest bank loan to invest in cryptocurrencies and stablecoins. Here’s how I used CoinDepo to grow my portfolio:

- Purchasing Cryptocurrencies: I used the loan to buy top cryptocurrencies like BTC, ETH, XRP, SOL, and ADA, focusing on stable assets with strong market performance.

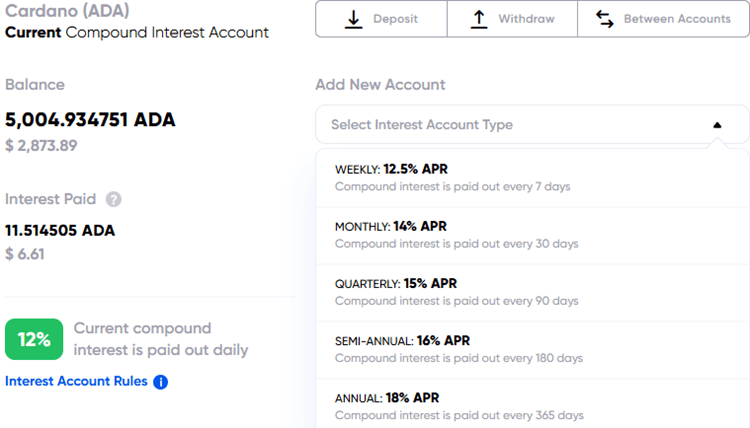

- Daily Interest Payouts: I deposited XRP and ADA into CoinDepo’s daily interest plan at 12% APR. A key advantage is the ability to swap these daily cryptocurrency payouts into stablecoins like USDT or USDC when the cryptocurrency price is at a good value, locking in profits and reducing volatility risks.

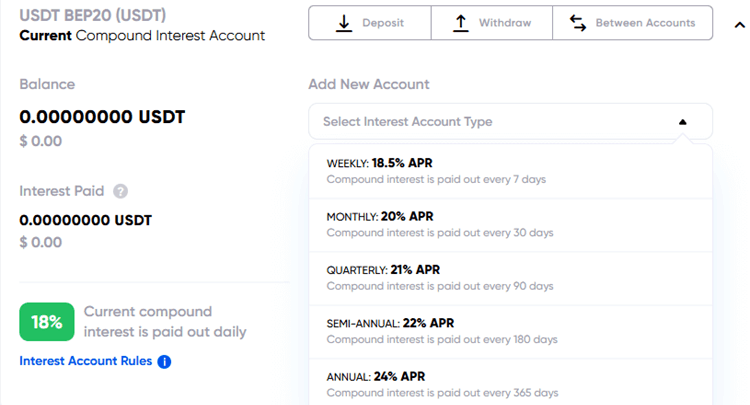

- Stablecoin Investments: For stablecoins (USDT ERC20, USDT TRC20, USDT BEP20, USDC, DAI), I opted for the daily plan at 18% APR, prioritizing frequent payouts for flexibility over higher APRs like the annual 24% option. Other plans include weekly (18.5%), monthly (20%), quarterly (21%), semi-annual (22%), and annual (24%).

The ability to choose payout frequencies, swap cryptocurrency earnings to stablecoins, and the absence of lock-up periods provide unmatched flexibility compared to platforms like Nexo.

Is CoinDepo’s Security System Reliable?

CoinDepo emphasizes asset security, making it a secure platform for crypto investments. Key features include:

- Fully Insured Assets: CoinDepo uses Fireblocks for custodial services, ensuring assets are fully insured against hacks or losses.

- Two-Factor Authentication: The platform requires identity verification and two-factor authentication, enhancing user account security.

- SOC 2 Type II Compliance: CoinDepo adheres to strict security standards, including multi-layer security systems and an overcollateralization mechanism for loans.

These measures reduce risks associated with crypto investments, addressing concerns about scams or platform instability.

CoinDepo’s Interest Rates and Payout Options

CoinDepo offers competitive interest rates, making it a profitable choice for earning passive income:

Cryptocurrencies:

- Daily: 12% APR (with option to swap to stablecoins)

- Weekly: 12.5% (7-day payout)

- Monthly: 14% (30-day payout)

- Quarterly: 15% (90-day payout)

- Semi-Annual: 16% (180-day payout)

- Annual: 18% (365-day payout)

Stablecoins:

- Daily: 18% APR

- Weekly: 18.5% (7-day payout)

- Monthly: 20% (30-day payout)

- Quarterly: 21% (90-day payout)

- Semi-Annual: 22% (180-day payout)

- Annual: 24% (365-day payout)

The compound interest payouts, especially on stablecoins, provide high returns while maintaining liquidity. For example, my daily interest payouts on ADA and stablecoins at 18% allow me to reinvest, swap to stablecoins when prices are favorable, or withdraw funds without restrictions.

Comparing CoinDepo to Other Staking Platforms

Compared to platforms like Nexo, CoinDepo’s flexibility and high APRs stand out. While Nexo offers similar crypto deposit services, CoinDepo’s no-lock-up daily plans, insured assets, and ability to swap cryptocurrency payouts to stablecoins provide a competitive edge. Additionally, CoinDepo’s transparency about its security standards and overcollateralization mechanism instills confidence in users.

Potential Risks and Considerations

While CoinDepo appears safe, no crypto platform is without risks. The crypto market is volatile, and while stablecoins and the swap feature mitigate this, cryptocurrencies like ETH or BNB can fluctuate. However, CoinDepo’s insured assets and daily withdrawal options minimize exposure. One drawback is the lack of a dedicated mobile app; currently, CoinDepo is accessible only via desktop, laptop, tablet, or mobile browsers like Chrome, Microsoft Edge, or Safari. While the browser-based interface is user-friendly, a mobile app would enhance convenience. Always diversify your portfolio and only invest what you can afford to lose.

Latest News and Updates on CoinDepo

Recent posts on X highlight CoinDepo’s focus on security and liquidity, with no reported scams or major issues since its launch. The platform’s referral program, offering up to $750 in USDC, also adds value for users.

Conclusion

CoinDepo is a secure and profitable platform for earning passive income through crypto staking. Its high APRs, flexible deposit options, ability to swap daily cryptocurrency payouts to stablecoins, and robust security features like two-factor authentication and insured assets make it a reliable choice. My experience using a low-interest loan to invest in XRP, ADA, and stablecoins at 18% daily APR has been rewarding, with daily payouts providing steady returns. Despite the lack of a mobile app, the browser-based platform is accessible and effective. For those looking to diversify their crypto portfolio, CoinDepo offers a compelling solution.