Introduction: Why You Need a Crypto Exit Strategy

The cryptocurrency market is a rollercoaster of euphoria and despair. In 2021, 97% of traders lost their gains due to a lack of discipline and a failure to exit at the right time. With the crypto market always volatile, having a robust crypto exit strategy is crucial to secure life-changing profits before the inevitable bear market hits. This guide breaks down a battle-tested plan to navigate the crypto market cycle, focusing on Bitcoin dominance, the OTHERS chart, and key sentiment indicators to time your exit perfectly.

Understanding the Crypto Market Cycle

The crypto market operates in distinct phases, each signaling different opportunities and risks. Knowing where we are in the cycle is critical to making informed decisions.

The Six Phases of the Crypto Market

-

Stocks (Phase 0): This initial phase involves the flow of money into traditional money markets and stocks. Excessive money printing drives capital into stocks, which then spills over into higher-risk assets like Bitcoin as investors seek greater returns.

-

Bitcoin Season (Phase 1): Bitcoin dominates the market with dominance above 60%. Altcoins typically underperform, and investors focus on holding Bitcoin, Ethereum, and other major coins.

-

ETH Season (Phase 2): Bitcoin dominance drops to 55-60%, and Ethereum starts gaining strength. This is the time to reduce Bitcoin exposure and invest in top 30 altcoins.

-

Large-Cap Season (Phase 3): Bitcoin dominance falls to 50-55%. Altcoins, especially mid- and large-caps, begin to pump. Start taking profits on sharp upward moves.

-

Altseason (Phase 4): Bitcoin dominance hits 45-50%, marking full-blown euphoria. Meme coins and low-caps skyrocket, but this is the time to aggressively take profits.

-

Bear Market (Phase 5): Bitcoin dominance drops below 45%, signaling a market crash. Portfolios can plummet by 70-90% if you fail to exit in time.

The key to success lies in preparing for the bear market (Phase 5) well before it arrives. While most traders obsess over entries, the real challenge is exiting with your profits intact.

Bitcoin Dominance: Your Primary Exit Tool

Bitcoin dominance—the percentage of the total crypto market cap attributed to Bitcoin—is the pulse of the market. It serves as the cornerstone of this crypto exit strategy, with specific dominance zones guiding your actions.

The Dominance Zones

-

(>60%): Bitcoin reigns supreme, and altcoins bleed. Hold Bitcoin, Ethereum, and major coins.

-

(55-60%): Ethereum and major altcoins start to stir. Reduce Bitcoin exposure and shift to top 30 altcoins.

-

(50-55%): Altseason begins, with mid- and low-cap coins pumping. Take profits on vertical price surges.

-

(45-50%): Euphoria takes over. Meme coins and low-caps soar, but this is a critical profit-taking window. Sell 80-90% of positions that achieve 10x gains to secure profits.

-

(<45%): The final warning. Exit all altcoin positions as the market nears a crash.

The Dominance Death Clock

When Bitcoin dominance falls below 50%, the “death clock” starts ticking. Historical data from 2017 and 2021 shows that the peak of altseason—marked by extreme euphoria—lasts just two weeks before a crash. In 2021, two euphoria cycles occurred (April and November), each lasting under a month. This tight window means you must act decisively to avoid being caught in the bear market.

The Altcoin Fire Alarm: The OTHERS Chart

The OTHERS chart tracks the total market cap of all altcoins excluding the top 10, representing the speculative, high-risk side of the market (meme coins, low-caps, and moonshots). This chart is a powerful tool for identifying the market’s peak.

The Double-Top Pattern

The OTHERS chart has consistently formed a double-top pattern during major bull runs (2017 and 2021):

-

First Peak: Altcoins surge vertically, and social media buzzes with euphoria. Bitcoin dominance is likely in the orange zone (45-50%).

-

Pullback: A sharp but shallow correction occurs, often dismissed as “healthy.”

-

Second Peak: A weaker rally with lower volume lures retail investors into buying low-quality coins at the worst time. This is the trap.

When the OTHERS chart shows signs of rolling over (forming the second peak), it’s your signal to exit. The first peak is your opportunity to take profits; the second is a dangerous trap for inexperienced traders.

Sentiment Signals: The Final Layer

While technical indicators like Bitcoin dominance and the OTHERS chart are critical, sentiment signals provide the final confirmation for your exit. These indicators highlight when retail investors are overly euphoric, signaling an imminent market top.

Key Sentiment Indicators

-

Fear and Greed Index: When the index hits extreme greed (80+), it indicates irrational market behavior. While it may stay elevated for a while, extreme greed combined with other signals is a strong exit cue.

-

Rolex Indicator: At market peaks, crypto traders flush with cash splurge on luxury goods like Rolex watches, causing their prices to spike. Monitor the “Rolex Index” on Google for additional confirmation.

-

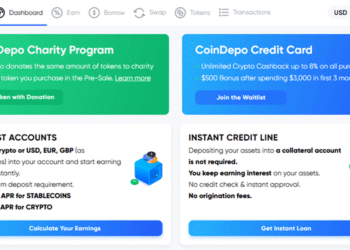

Coinbase App Ranking: When the Coinbase app climbs to the top three on the App Store, it signals a flood of unsophisticated retail investors entering the market. This FOMO-driven influx is a reliable sign that the bubble is about to pop.

When the death clock is ticking (Bitcoin dominance <50%), the OTHERS chart is rolling over, and sentiment indicators like extreme greed, Rolex price spikes, and Coinbase app rankings align, it’s time to execute your exit plan.

Your Crypto Exit Strategy: Step-by-Step

This crypto exit strategy isn’t about timing the absolute market top—no one can do that consistently. Instead, it’s about exiting on strength with a disciplined plan. Here’s how to put it into action:

-

Monitor Bitcoin Dominance: Track dominance levels daily using platforms like TradingView or CoinMarketCap. When dominance drops below 50%, the two-week death clock begins.

-

Watch the OTHERS Chart: Look for the double-top pattern in the altcoin market cap (excluding the top 10). Exit at the first peak to avoid the second peak’s trap.

-

Layer Sentiment Signals: Confirm your exit with the Fear and Greed Index (extreme greed), Rolex price spikes, and Coinbase app rankings in the top three.

-

Take Profits Aggressively: In the orange zone (45-50% dominance), sell 80-90% of positions that achieve 10x gains. Leave a small portion for potential further upside but secure the majority of your profits.

-

Fully Exit in the Red Zone: When Bitcoin dominance falls below 45%, exit all altcoin positions to avoid the bear market crash.

Common Mistakes to Avoid

-

Chasing Euphoria: Don’t fall for the trap of holding for “one more pump.” The orange zone’s 10x gains are life-changing—take them.

-

Ignoring the Death Clock: Two weeks is all you have during peak altseason. Hesitation can cost you everything.

-

Neglecting Sentiment: Technical indicators alone aren’t enough. Sentiment signals like the Coinbase app ranking provide critical context.

-

No Plan: Without a predefined exit strategy, you’re just exit liquidity for disciplined investors.

Conclusion: Trade Smart, Secure Your Profits

The crypto market can be a goldmine, but only if you know when to cash out. By using Bitcoin dominance, the OTHERS chart, and sentiment indicators, you can time your exit to secure profits before the next bear market hits. Discipline is the difference between walking away with life-changing wealth and holding bags of worthless tokens. Start preparing your crypto exit strategy now, and don’t let euphoria cloud your judgment.