XRP, the native cryptocurrency of the XRP Ledger, is designed for efficient cross-border payments in a volatile crypto market. As of July 17, 2025, XRP trades at about $3.05, up 1.5% in the last 24 hours with a trading volume of $8.78 billion (CoinGecko data). It faces resistance near $3.10, with the daily RSI at 65—showing bullish momentum but room for pullback. This guide breaks down XRP’s basics, tech, and market factors in simple terms, using data for clarity.

Highlighted XRP Price Milestone:

- All-Time High (ATH): $3.84, achieved on January 4, 2018, during the 2017-2018 bull run (Coin Market Cap Data). No new ATH has been set in 2025, despite recent surges.

Ripple and XRP

Ripple Labs, founded in 2012 by Chris Larsen, Jed McCaleb, and Arthur Britto, operates as a technology company focused on enhancing global payments through blockchain solutions. The firm developed the XRP Ledger, an open-source platform where XRP serves as the native cryptocurrency. While Ripple and XRP are often referenced interchangeably, Ripple refers to the company, whereas XRP is the digital asset used for transactions. At launch, a total supply of 100 billion XRP tokens was pre-mined, with Ripple Labs initially holding 80 billion to support ecosystem development and liquidity.

XRP’s price has been influenced by adoption in cross-border payments, where it acts as a bridge currency to reduce settlement times and costs compared to traditional systems. Data from Ripple’s quarterly reports show that on-demand liquidity (ODL) volumes, which leverage XRP, grew by 20% year-over-year in Q2 2025, driven by partnerships with financial institutions in Asia and Europe. However, XRP’s centralized supply distribution— with Ripple Labs still controlling a significant portion—has raised questions about decentralization, contrasting with proof-of-work models like Bitcoin. Market participants note that XRP’s value often correlates with regulatory news, with the 50-day moving average currently at $2.80 providing near-term support.

XRP Ledger

The XRP Ledger (XRPL), launched in 2012, is a decentralized blockchain designed for high-speed transactions, capable of processing up to 1,500 transactions per second with average fees below $0.0002, per on-chain metrics from XRPL.org. Unlike Bitcoin’s energy-intensive proof-of-work consensus, the XRPL employs a unique consensus protocol involving a network of validators to confirm transactions, resulting in settlement times of 3-5 seconds and a carbon-neutral footprint.

The ledger supports a range of digital assets beyond XRP, including tokenized IOUs and custom tokens, making it suitable for applications like currency exchange and remittances. Recent data from Messari indicates that daily active addresses on the XRPL have increased by 15% in the past month to over 50,000, signaling growing network activity amid broader crypto recovery. However, critics point to the ledger’s reliance on a select group of validators, often affiliated with Ripple Labs, as a potential vulnerability, though historical uptime exceeds 99.9% since inception.

Cryptocurrency

XRP ranks among the top cryptocurrencies by market capitalization, currently at $180.78 billion, trailing leaders like Bitcoin and Ethereum. As a digital asset, XRP is optimized for utility in financial transactions, differing from Bitcoin’s store-of-value narrative. Its pre-mined total supply of 100 billion tokens aims to prevent inflation, with a circulating supply of 59.13 billion as of mid-2025.

Trading volume data from exchanges like Binance and Coinbase show XRP’s 24-hour volume averaging $8-10 billion during bullish phases, reflecting strong liquidity. Investors should monitor macroeconomic factors, such as U.S. interest rate decisions, which have historically impacted XRP’s correlation with risk assets—currently at 0.7 with the S&P 500. The cryptocurrency market’s volatility remains a key risk, with XRP’s 30-day realized volatility at 45%, lower than its 2018 peak but still elevated compared to traditional currencies.

Bitcoin

Bitcoin, the pioneering cryptocurrency, operates on a proof-of-work blockchain with a capped supply of 21 million coins, emphasizing decentralization and security through mining. In comparison, XRP’s consensus mechanism prioritizes efficiency, enabling faster and cheaper transactions but at the expense of perceived centralization. Price data reveals that Bitcoin’s dominance index stands at 55% as of July 2025, while XRP holds around 3%, with both assets often moving in tandem during market cycles—XRP’s beta to Bitcoin is approximately 1.2.

Use cases diverge: Bitcoin is increasingly adopted as a treasury asset by corporations, with over 1 million BTC held by public companies, per Arkham Intelligence. XRP, meanwhile, targets institutional payments, though its adoption has been tempered by competition from stablecoins like USDT, which boast daily volumes exceeding $100 billion.

Ledger

In blockchain contexts, a ledger serves as a distributed database for immutable transaction records. The XRP Ledger distinguishes itself with its consensus-based validation, avoiding the computational overhead of mining seen in Bitcoin’s ledger. Validators, numbering over 150 globally, ensure network integrity, with transaction throughput data from the XRPL Foundation showing peaks of 80 million daily confirmations during high-activity periods.

Comparative analysis indicates the XRP Ledger’s edge in scalability for high-volume use cases, such as micropayments, where Bitcoin’s average block time of 10 minutes limits throughput to 7 transactions per second.

Blockchain

Blockchain technology underpins XRP through the XRPL, providing a transparent and secure framework for value transfer. The XRPL’s design incorporates features like payment channels for off-chain scaling, contrasting with Bitcoin’s on-chain focus. Adoption metrics from Chainalysis reveal that blockchain-based remittances using XRP have saved an estimated $1 billion in fees annually for users in emerging markets.

Technical indicators, such as the XRPL’s hash rate equivalent in validator agreement, remain stable, supporting its role as an alternative to traditional financial infrastructure.

SEC

The U.S. Securities and Exchange Commission (SEC) initiated legal action against Ripple Labs in 2020, alleging that XRP sales constituted unregistered securities offerings. The case, resolved in 2023 with a partial ruling favoring secondary market sales, led to a 30% price rally for XRP at the time. By 2025, with appeals concluded, XRP’s regulatory clarity has improved, evidenced by relistings on major exchanges and ETF applications under review.

Market observers note that the SEC’s stance has influenced broader crypto classifications, with XRP’s trading volume surging 25% post-resolution.

Cross-Border Payments

Cross-border payments represent a core use case for XRP, where it functions as a bridge currency to minimize friction in international transfers. Ripple’s ODL service has processed over $30 billion in volume since 2019, reducing costs by up to 60% compared to SWIFT, according to RippleNet data. The XRPL’s efficiency supports this, with settlement times far outpacing traditional methods.

Use Cases

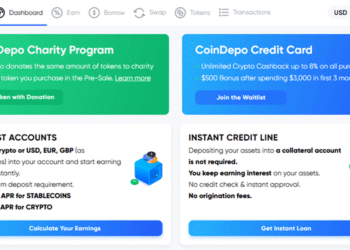

XRP’s applications extend to micropayments, DeFi protocols on the XRPL, and asset tokenization. Financial institutions utilize it for liquidity management, while on-chain data shows a 10% increase in DeFi TVL on the ledger to $500 million in 2025.

Crypto Exchange

XRP is available on major crypto exchanges, with average daily volume distributed across platforms like Binance (40%) and Upbit (20%). Post-SEC clarity, liquidity has improved, with bid-ask spreads narrowing to 0.05%.

Disadvantages of XRP

Potential drawbacks include centralization risks from Ripple’s supply holdings, which could impact price stability, and regulatory uncertainties in non-U.S. jurisdictions. Volatility data places XRP’s 1-year standard deviation at 60%, higher than Bitcoin’s 50%.

Alternative to Traditional

XRP offers an alternative to traditional payment networks by leveraging blockchain for faster, lower-cost transactions, with adoption in remittances growing at 15% annually per World Bank estimates. As the cryptocurrency market evolves, XRP’s utility could drive further integration with fiat systems, though competition from CBDCs remains a watchpoint.