Introduction

Have you ever wondered how cryptocurrencies could seamlessly integrate with traditional banking systems? As of July 2025, with the Fedwire Funds Service freshly adopting ISO 20022 on July 14, the financial world is buzzing about this global standard. ISO 20022 is revolutionizing financial messaging, enabling richer data exchanges that boost efficiency in transactions. In this comprehensive guide, we’ll unpack what ISO 20022 is, its benefits for the crypto space, and spotlight the top ISO 20022 compliant cryptocurrencies poised for growth.

This shift isn’t just for banks—it’s a game-changer for blockchain networks and digital assets. With ISO 20022 compliance, cryptos like XRP and Stellar are bridging the gap between crypto and the traditional financial system, enhancing interoperability and cross-border payments. Whether you’re a crypto enthusiast or investor, understanding ISO 20022 coins could help you spot opportunities in 2025’s evolving market.

What Is ISO 20022?

ISO 20022 is an international standard for electronic data interchange between financial institutions, developed by the International Organization for Standardization (ISO). It serves as a common language for financial messages, using XML-based syntax to structure data richly and consistently. This standard covers payments, securities, trade, and more, making it a versatile tool for the financial services industry.

At its heart, ISO 20022 provides a metadata repository that defines message types, components, and flows. Unlike older formats like SWIFT MT, which often limit data fields, ISO 20022 allows for detailed information such as remittance details and party identifiers. This enables better reconciliation and compliance in transactions.

As a global financial messaging standard, ISO 20022 promotes standardization across payment systems. It’s syntax-independent but commonly uses XML, ensuring flexibility for various business areas. For crypto, this means blockchains can align with ISO 20022 to facilitate smoother integrations with banks.

Key Features of ISO 20022

- Structured Data: Enhances accuracy in financial messages.

- Interoperability: Supports seamless communication between systems.

- Extensibility: Easily adapts to new requirements like digital assets.

Benefits of ISO 20022 Compliance

The benefits of ISO 20022 are profound, particularly in a world craving faster transactions. It offers richer data, leading to improved analytics, reduced manual processes, and stronger fraud prevention. For financial institutions, this translates to operational efficiency and better customer experiences through transparent payments.

In cross-border payments, ISO 20022 standardizes messaging formats, minimizing errors and costs. It’s vital for instant payments, as seen in systems like FedNow, where structured data drives modernization. Adoption fosters a common language across the payments chain, benefiting reconciliation and regulatory adherence.

For the crypto industry, ISO 20022 compliance enhances blockchain’s speed with standardized protocols, promoting adoption in traditional finance. This interoperability could lead to more crypto use in high-value transactions, boosting overall market maturity.

Top Benefits Include:

- Efficiency Gains: Faster processing with less intervention.

- Risk Mitigation: Improved compliance and fraud detection.

- Innovation Boost: Enables new services like real-time cross-border transfers.

As more entities adopt ISO 20022, these advantages are accelerating its global rollout.

ISO 20022 Migration Status in 2025

The ISO 20022 migration has reached key milestones by July 2025. The Federal Reserve implemented ISO 20022 for the Fedwire Funds Service on July 14, 2025, marking a single-day switch to enhance payment capabilities. This aligns the U.S. with international standards, supporting richer data in wire payments.

SWIFT’s migration for cross-border payments began in March 2023, with the coexistence period for legacy MT messages ending on November 22, 2025. By then, all financial institutions must fully adopt ISO 20022 for payments instructions to avoid disruptions.

Globally, nearly 200 market infrastructures are implementing or planning ISO 20022 initiatives. This widespread adoption is driving the financial system toward greater efficiency and interoperability.

Preparing for Full Adoption

Financial institutions should:

- Update systems to handle ISO 20022 messages.

- Train teams on new formats.

- Test integrations with partners.

With the November 2025 deadline approaching, proactive steps are essential.

ISO 20022 and Cryptocurrencies: Why Compliance Matters

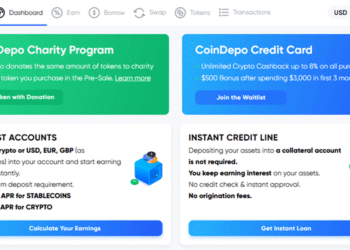

ISO 20022 compliance is transforming the crypto space by enabling digital assets to integrate with traditional financial systems. Compliant cryptocurrencies use protocols that align with ISO 20022 standards, facilitating cross-border transactions and interoperability between blockchains and banks.

This standard acts as a bridge, allowing crypto to participate in regulated payment networks. For instance, it standardizes transaction data, making it easier for crypto exchanges to comply with global regulations. As central bank digital currencies (CBDCs) emerge, ISO 20022 compliant coins could play a key role in hybrid systems.

In 2025, with Fedwire’s recent adoption, ISO 20022 coins like XRP are positioned for increased utility in real-world finance. This compliance enhances trust, attracting institutional investors to the crypto market.

Impact on Blockchain Networks

- Seamless Integration: Blockchains can communicate in a common language with legacy systems.

- Enhanced Transactions: Richer data supports complex crypto transactions.

- Regulatory Alignment: Aids in meeting standards for anti-money laundering and more.

Top ISO 20022 Compliant Cryptocurrencies in 2025

As the financial world embraces ISO 20022, several cryptocurrencies stand out for their compliance. These ISO 20022 coins are designed to interoperate with traditional systems, making them attractive for cross-border payments and beyond. Here’s a list of the top ISO 20022 compliant cryptocurrencies as of July 2025:

1. Ripple (XRP)

XRP is a leader among ISO 20022 compliant cryptos, optimized for fast, low-cost cross-border payments. Its blockchain network uses ISO 20022 messaging to facilitate seamless transactions between banks. With partnerships in over 100 countries, XRP’s token is inherently compliant, boosting its role in global finance.

2. Stellar (XLM)

Stellar focuses on affordable cross-border transactions, aligning with ISO 20022 for interoperability. This cryptocurrency enables quick settlements, making it ideal for remittances. XLM’s protocol supports structured data, enhancing its appeal for financial institutions.

3. Cardano (ADA)

Cardano’s smart contract platform is evolving to fully support ISO 20022 compliance. ADA powers decentralized finance (DeFi) applications that integrate with traditional systems. Its focus on sustainability and scalability positions it as a top ISO 20022 coin for long-term growth.

4. Hedera (HBAR)

Hedera offers enterprise-grade blockchain solutions compliant with ISO 20022. HBAR facilitates high-speed transactions with low fees, suitable for supply chain and payments. Governed by major corporations, it’s a reliable choice for compliant crypto.

5. IOTA (MIOTA)

IOTA’s tangle technology is tailored for machine-to-machine payments, aligning with ISO 20022 standards. It supports feeless transactions and is ideal for IoT ecosystems. This digital asset’s compliance ensures secure data exchanges in industrial applications.

6. XDC Network (XDC)

XDC is a hybrid blockchain for trade finance, fully compliant with 20022 ISO standards. The XDC token enables smart contracts for international trade, bridging public and private blockchains.

7. Algorand (ALGO)

Algorand provides pure proof-of-stake with ISO 20022 compatibility for fast transactions. ALGO is used in DeFi and NFTs, with strong emphasis on security and speed.

8. Quant (QNT)

Quant’s Overledger connects multiple blockchains, enabling ISO 20022 compliant transactions. QNT is key for interoperability in multi-chain environments, attracting enterprise adoption.

These compliant cryptocurrencies are seeing renewed interest post-Fedwire shift, with potential price impacts.

Future of ISO 20022 in Crypto

The future of ISO 20022 looks bright for crypto, as more blockchains adopt the standard to enhance interoperability. By aligning with ISO 20022, cryptocurrencies can participate in central bank digital currencies and global payment networks, driving mainstream adoption.

In 2025, with SWIFT’s full migration in November, expect increased use of ISO 20022 coins in cross-border transactions. This could boost crypto’s role in the financial system, from crypto exchanges to institutional investments.

Challenges include regulatory scrutiny, but benefits like standardized messaging will prevail, fostering innovation.

Emerging Trends

- CBDC Integration: Compliant cryptos may link with digital currencies.

- DeFi Expansion: Richer transaction data enables advanced applications.

- Market Growth: More crypto projects will seek ISO 20022 compliance.

Frequently Asked Questions

What is ISO 20022 compliance for crypto?

It’s when cryptocurrencies align with the ISO 20022 standard for financial messaging, enabling integration with banks.

Which are the best ISO 20022 compliant cryptos in 2025?

Top ones include XRP, Stellar, Cardano, and Hedera.

Has the ISO 20022 migration completed in 2025?

Fedwire yes on July 14; SWIFT ends coexistence in November 22.

How does ISO 20022 benefit crypto investors?

It enhances legitimacy, interoperability, and potential value through traditional finance ties.

Conclusion

ISO 20022 is the cornerstone of modern financial messaging, with its 2025 adoptions marking a pivotal year for compliant cryptocurrencies. From benefits like improved cross-border payments to the list of top coins such as XRP and Algorand, this standard is fueling blockchain’s convergence with traditional systems. As the migration wraps up, these ISO 20022 coins offer exciting prospects for investors.